State of the Nation 2024

Last updated: 2 April 2024

Look inside the hearts and minds of Kiwi buyers and sellers, and the future of property in NZ.

Foreword: Insights to guide you in the year ahead

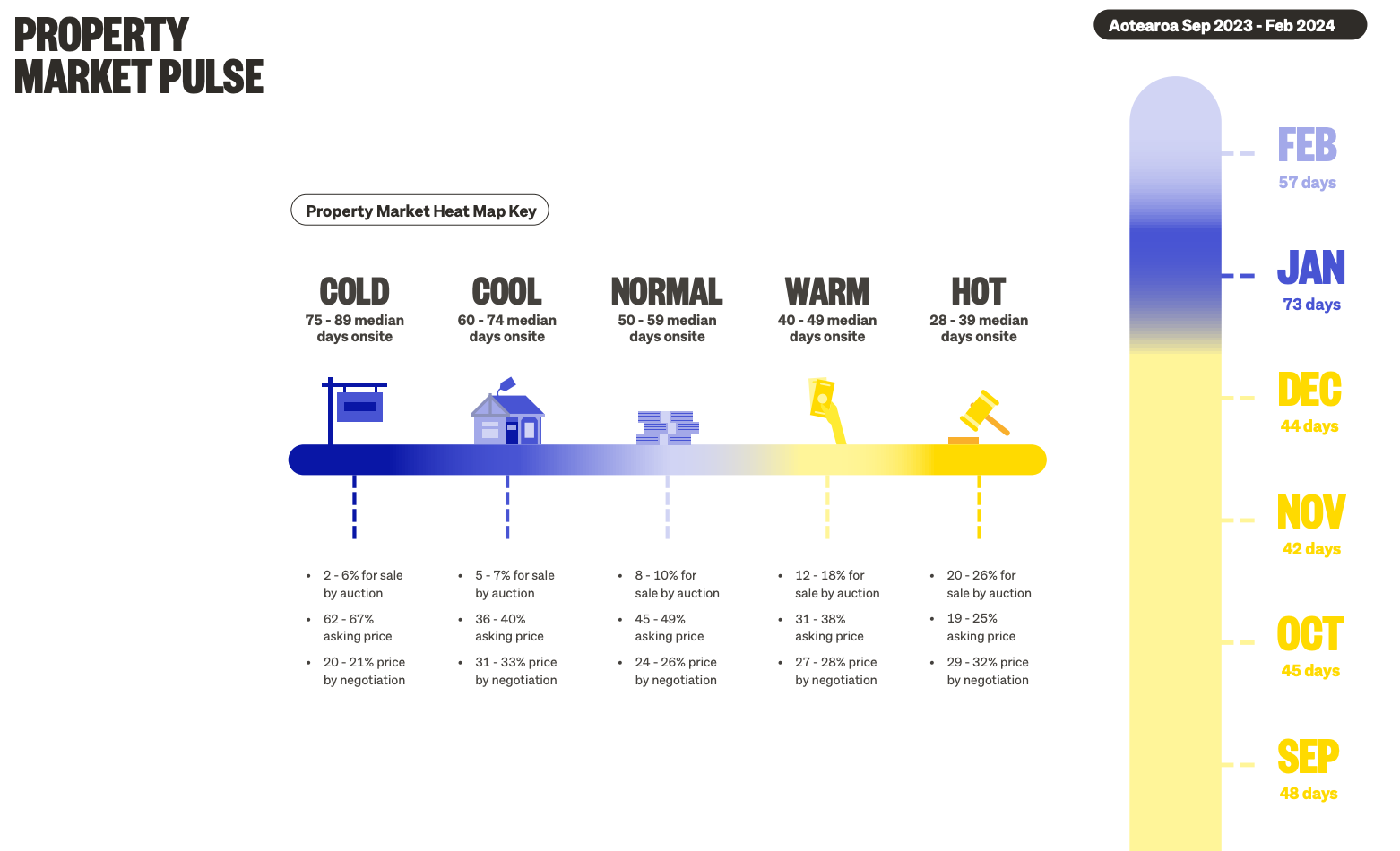

An economic overview: The road ahead for Aotearoa

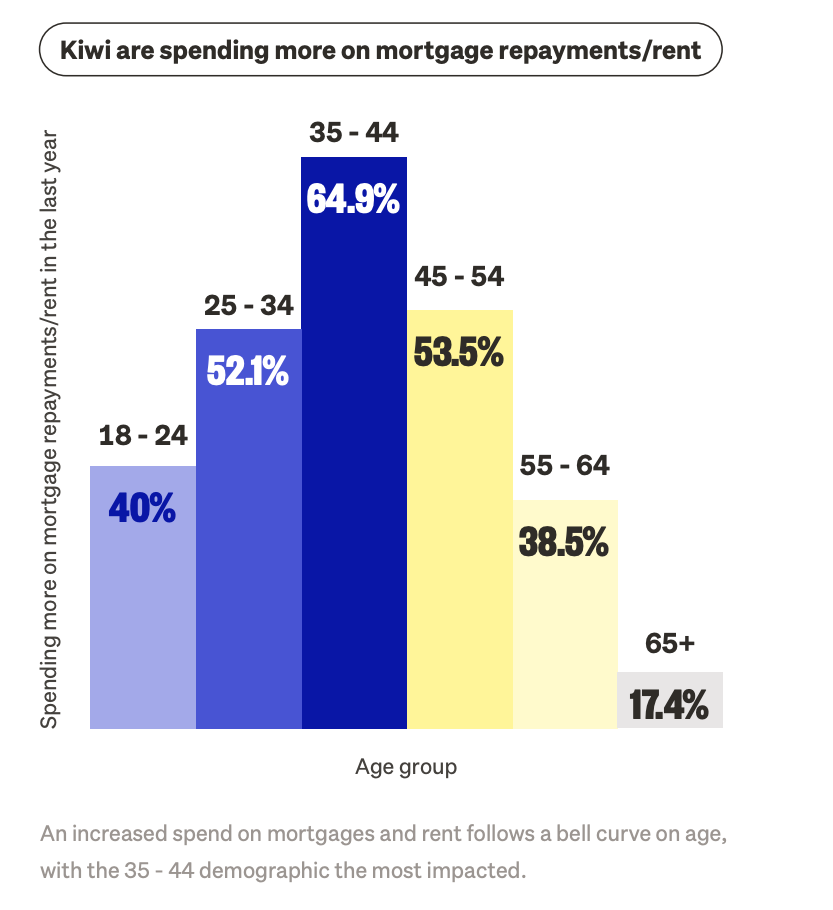

What’s on the mind of the nation? The impact of the everyday economy

A shift in priorities and behaviours

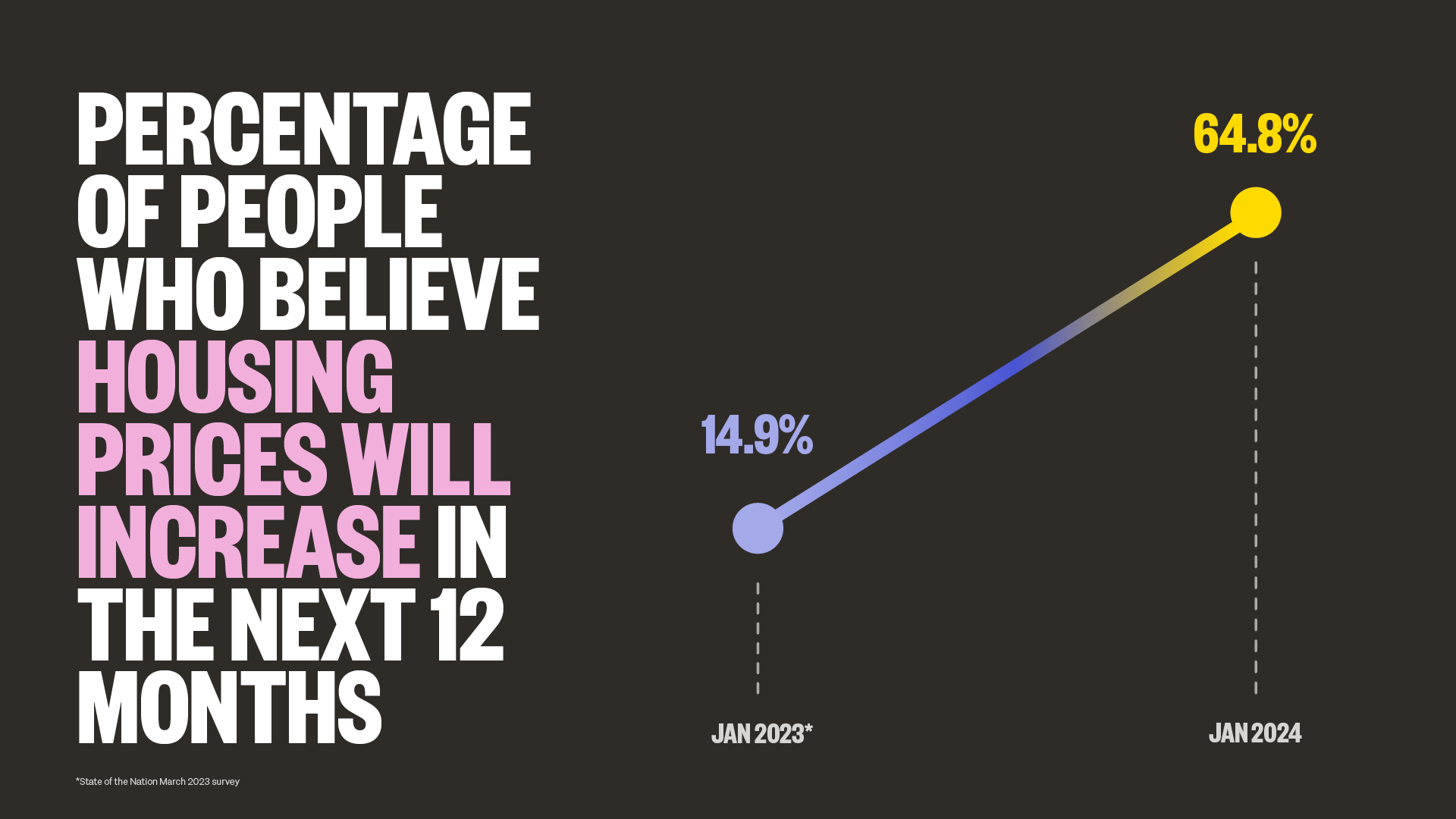

The 2024 buyer mindset

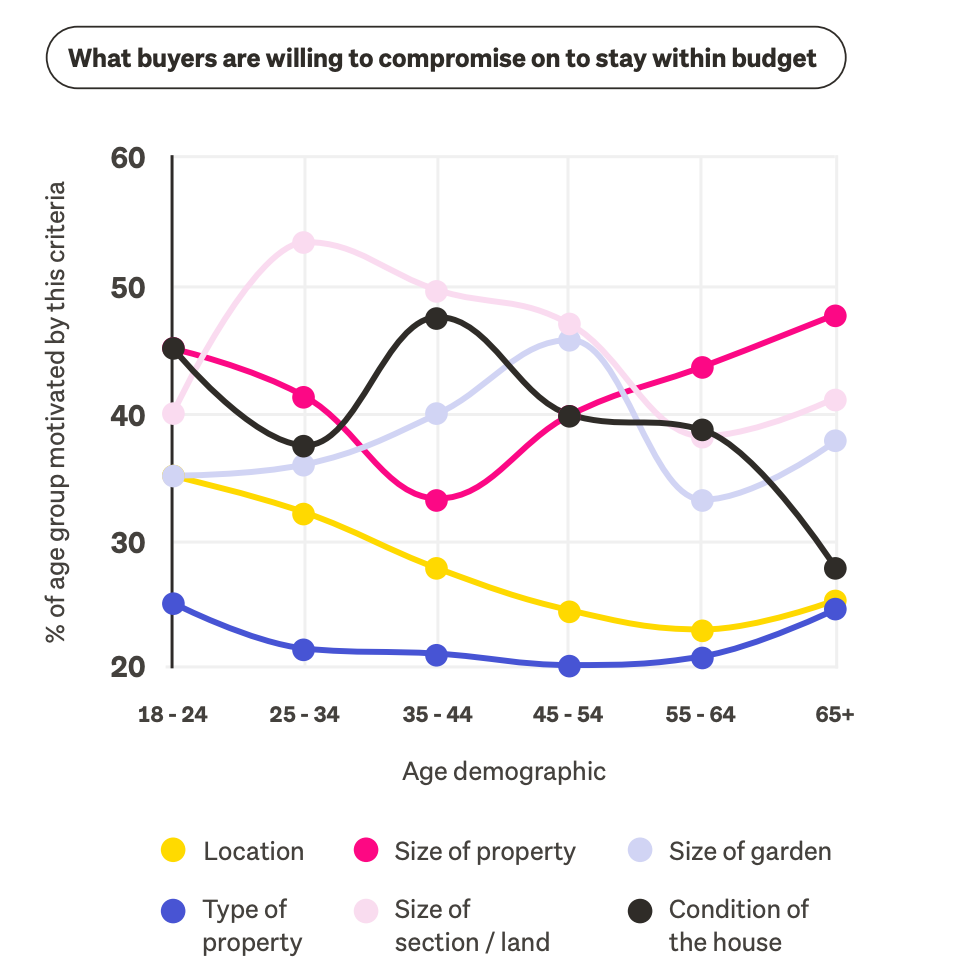

Affordability is key - and buyers are willing to compromise

What does this mean for the market?

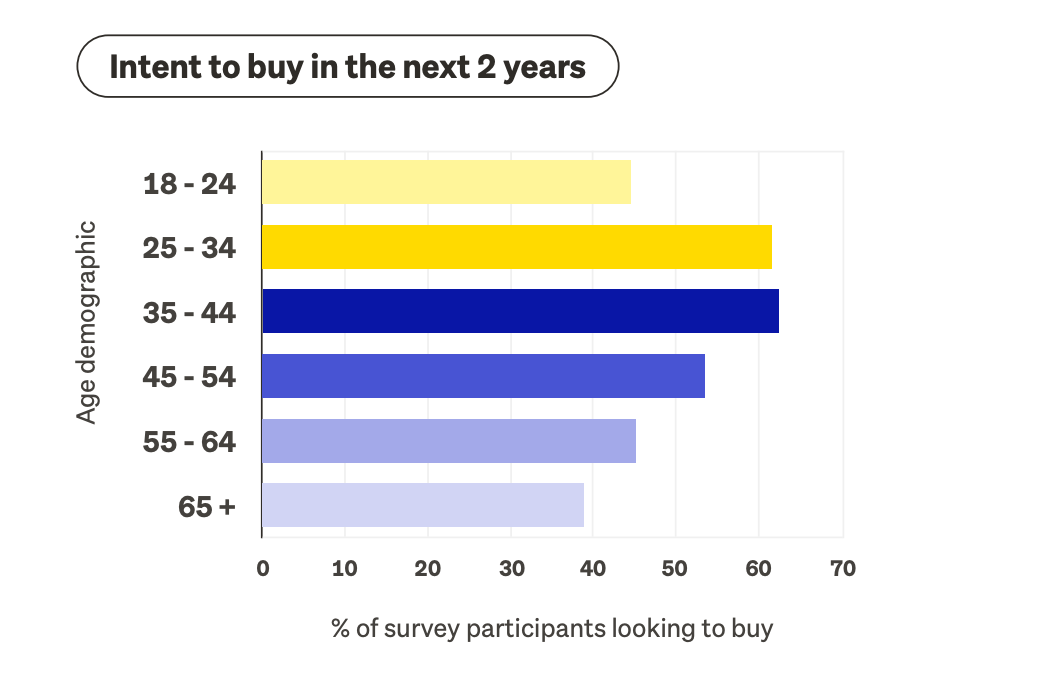

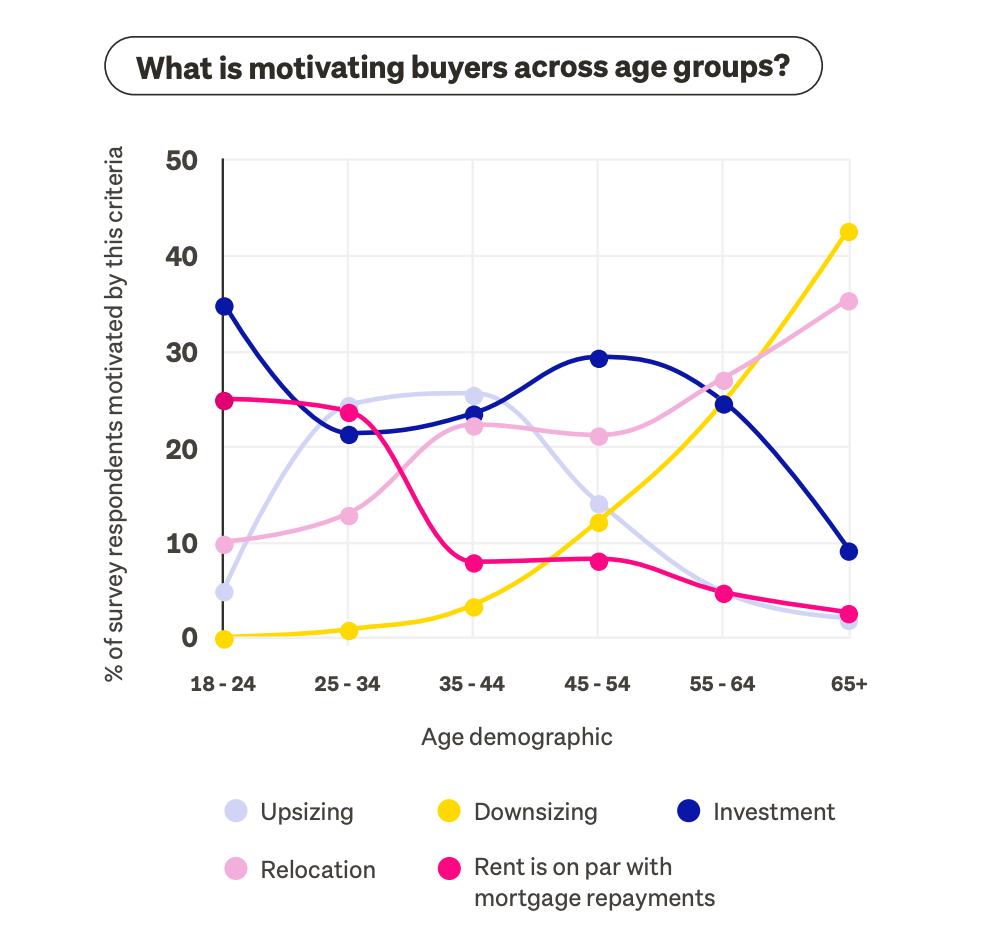

Buyer intentions and motivations

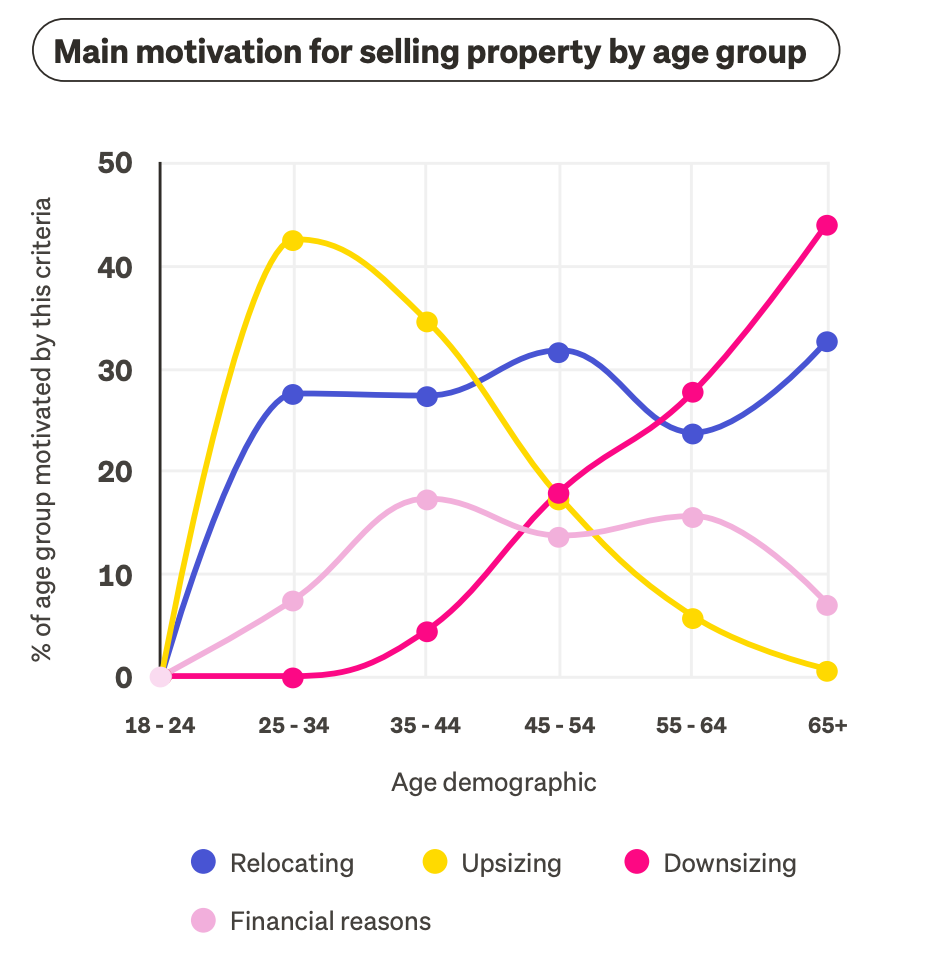

A Double Click on Age Demographics

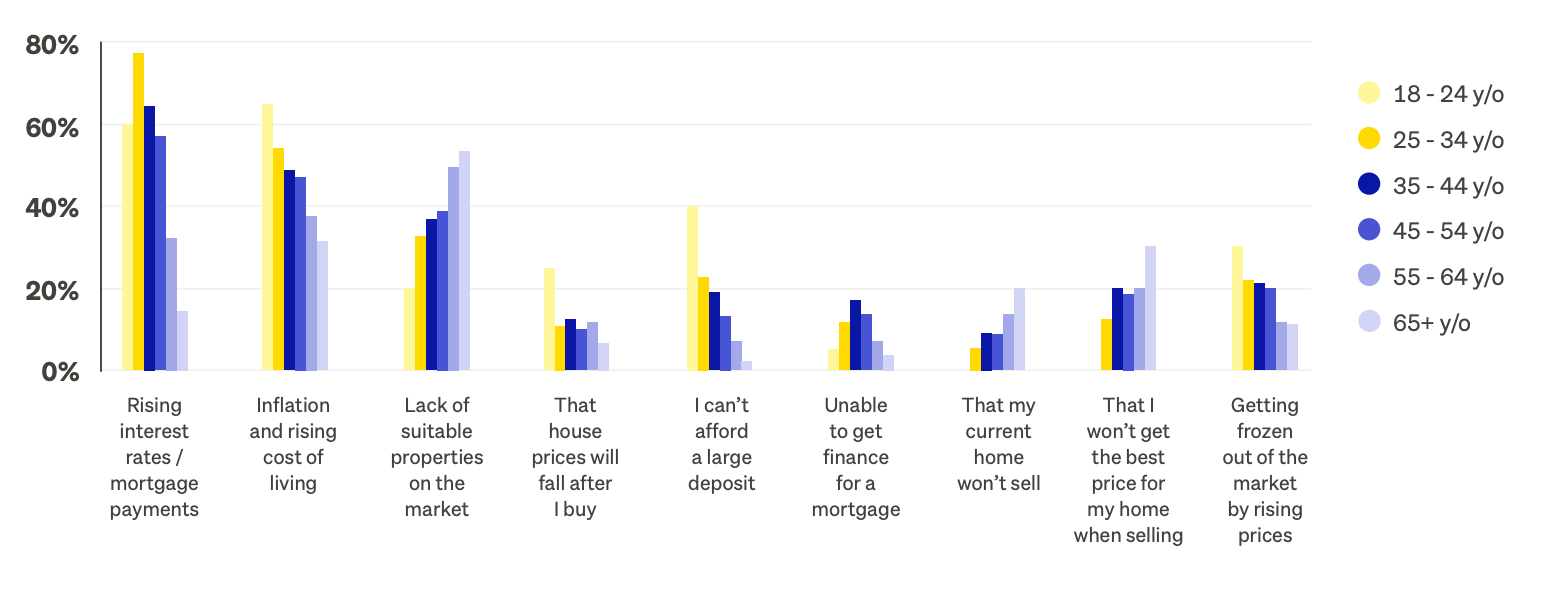

Biggest concerns about buying

The 2024 seller mindset

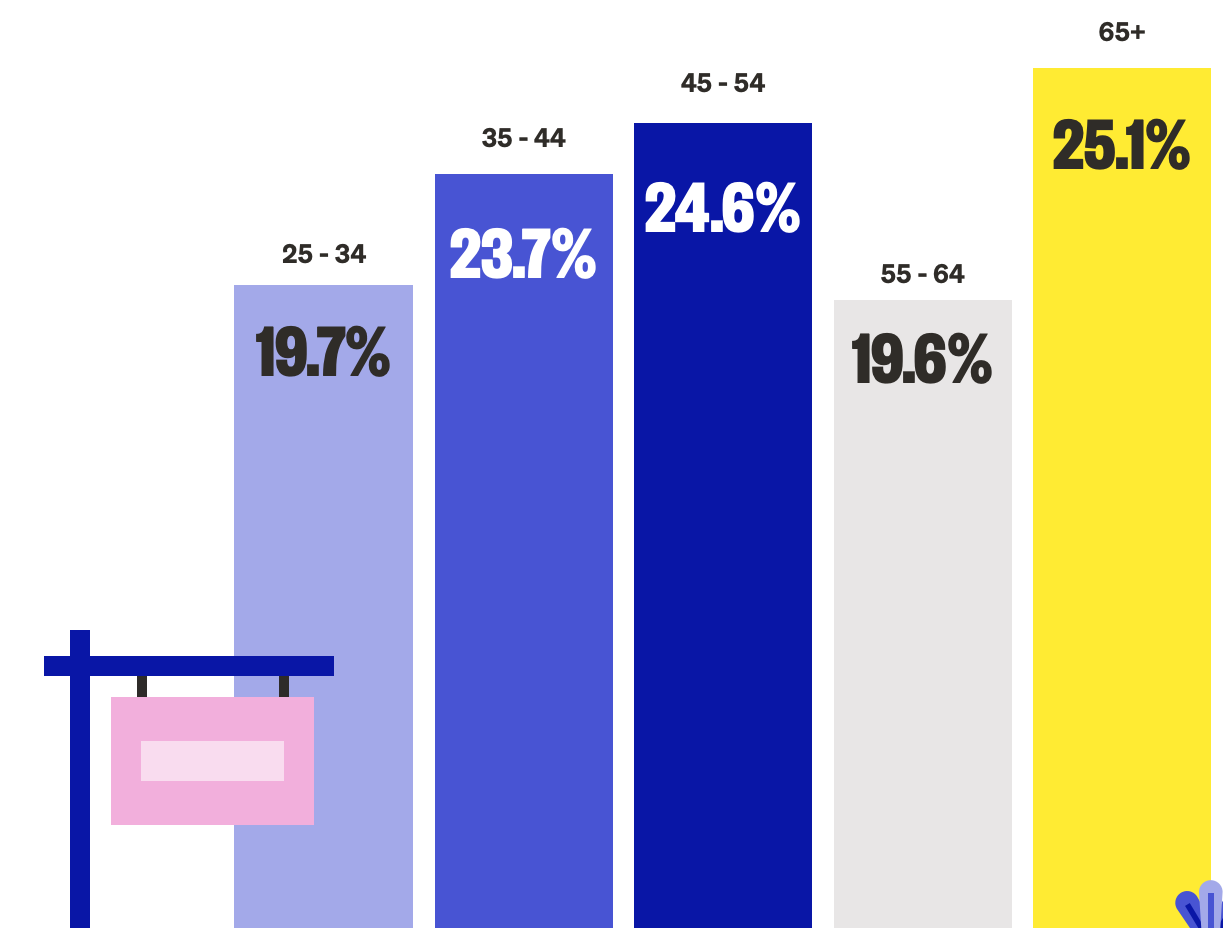

Intent to sell in the next 12 months (by age group)