Buying guide

What do property valuers look for?

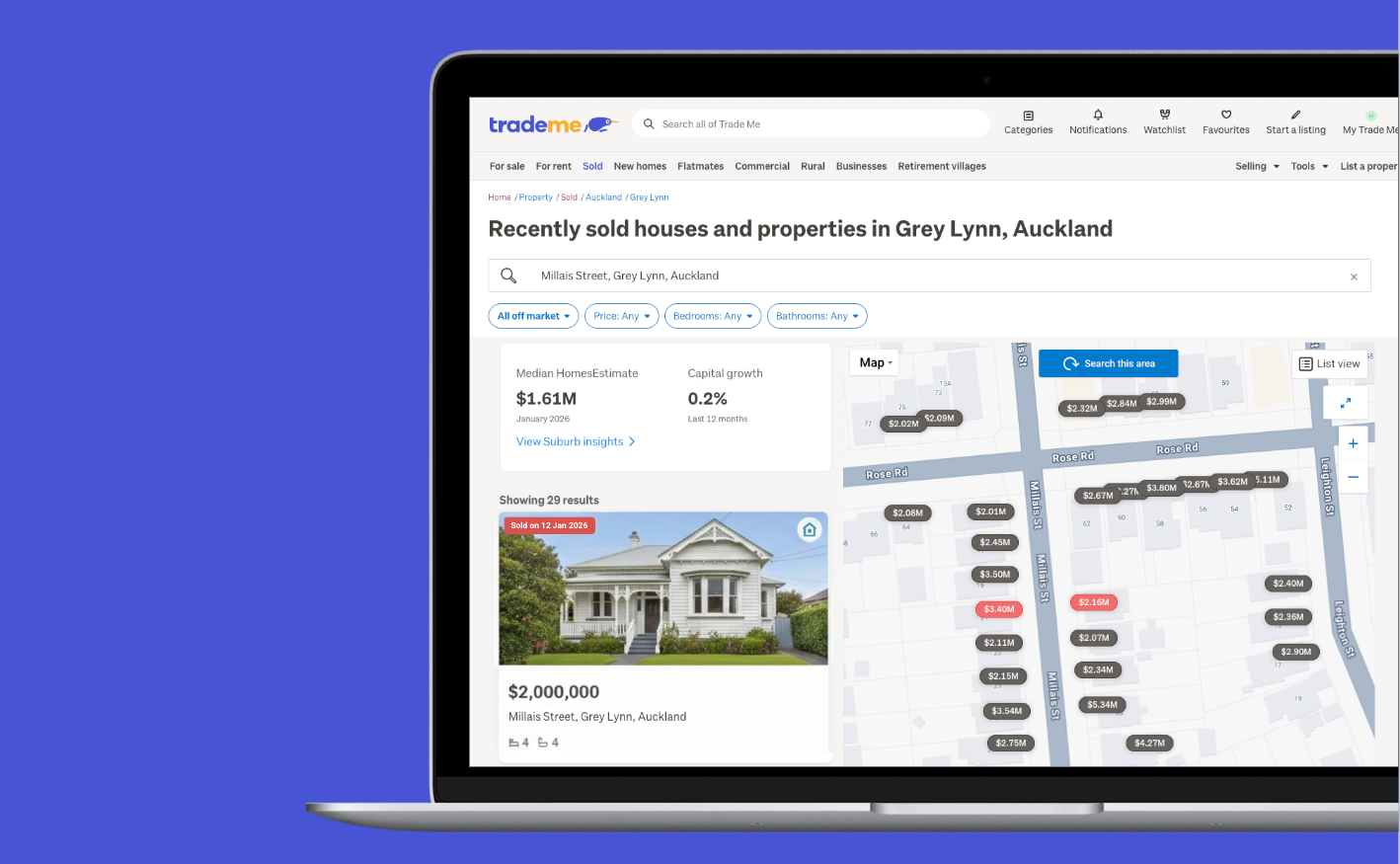

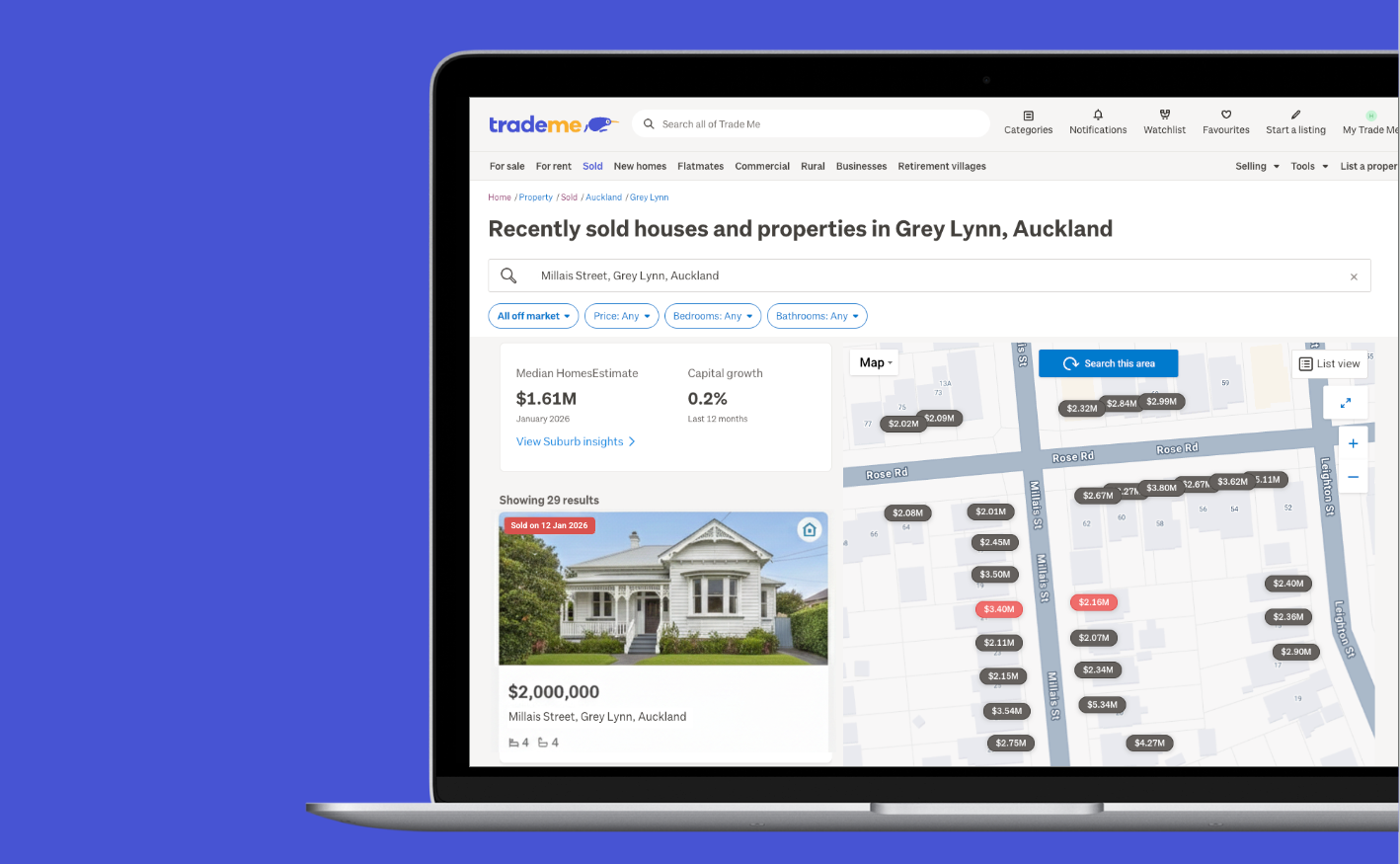

How to know what your home is worth

Why people use property valuers

You can do your own research to start with, then call on property valuers if you want a more detailed picture.

What do property valuers look for?

1. The house

2. The land

3. The area

Property valuers will take into consideration the local area when deciding how much your home is worth.

The market context

Author

Discover More

Derelict for 40 years: 1860s cottage beautifully restored by ‘hopeless romantics’

John and Janet Adams have renovated this historical cottage into a cosy haven that honours its rich past

‘People knock on the door because it’s such an amazing spot’: Coffee industry hotshot selling waterfront home

Peek inside Wellington architecturally designed waterfront home

Search

Other articles you might like

.jpg?w=1440&fit=max)