News Next article

Rents hold steady as Kiwi prepare for a busy summer

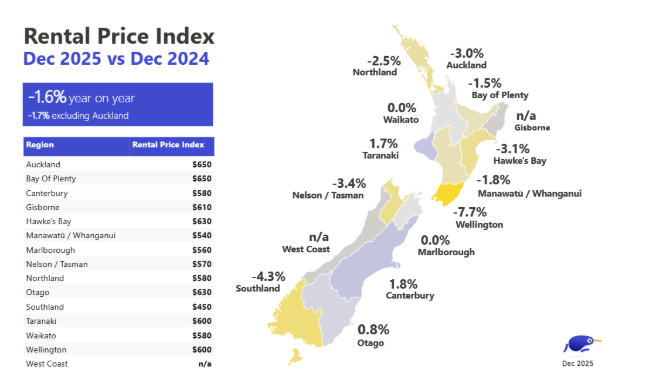

Rental Price Index - December 2025

By Casey Wylde 26 January 2026"

"

Casey Wylde

Trade Me Property spokesperson

National median rental prices - December 2024 v December 2025

Demand heats up while supply takes a dip

Regional highlights: Auckland and Bay of Plenty lead the pack

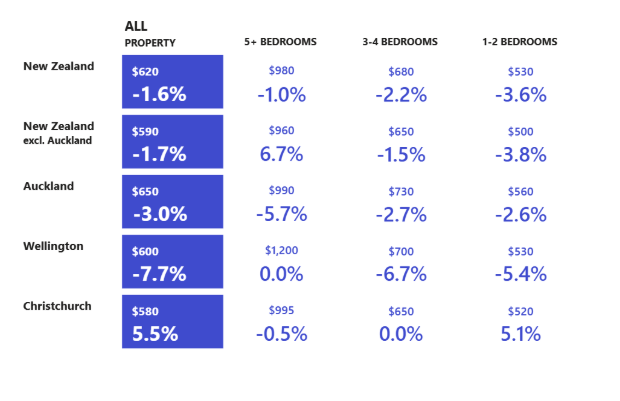

Urban property type prices and year-on-year movement

| Region | Rental Price Index | ||

|---|---|---|---|

| Auckland | Auckland | $650 | $650 |

| Bay of Plenty | Bay of Plenty | $650 | $650 |

| Canterbury | Canterbury | $580 | $580 |

| Gisborne | Gisborne | $610 | $610 |

| Hawke's Bay | Hawke's Bay | $630 | $630 |

| Manawatu/Whanganui | Manawatu/Whanganui | $540 | $540 |

| Marlborough | Marlborough | $560 | $560 |

| Nelson/Tasman | Nelson/Tasman | $570 | $570 |

| Northland | Northland | $580 | $580 |

| Otago | Otago | $630 | $630 |

| Southland | Southland | $450 | $450 |

| Taranaki | Taranaki | $600 | $600 |

| Waikato | Waikato | $580 | $580 |

| Wellington | Wellington | $600 | $600 |

| West Coast | West Coast | N/A | N/A |

Most properties, more choice

Explore endless possibilities on NZ's favourite property app.

Download on iOS Download on Android Author