Buying guide

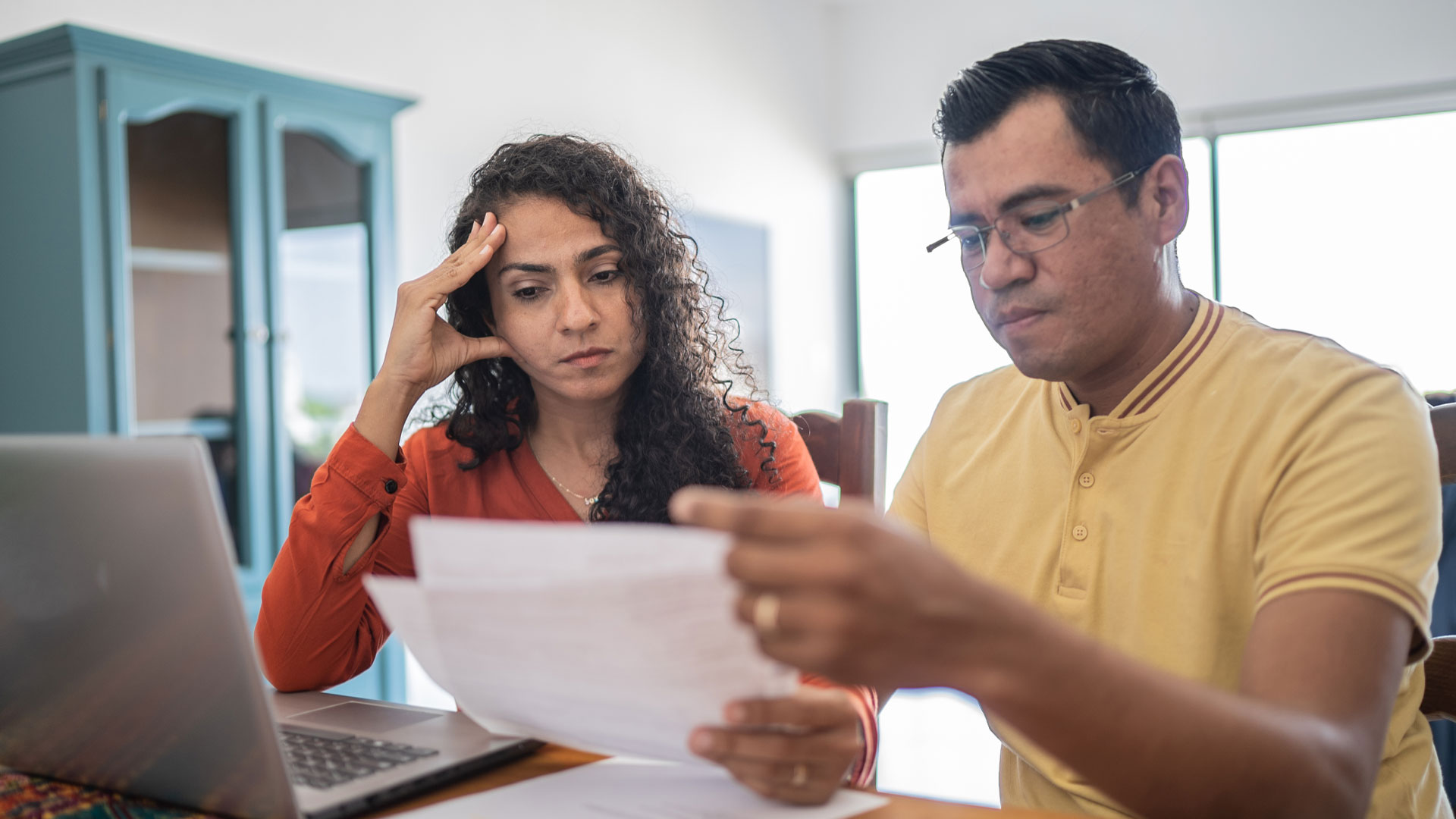

Can I back out after making an offer on a home?

The nature of the offer you made will impact your options.

.png)

What does it mean to “make an offer” on a home in NZ?

Whether you made a conditional or unconditional offer will have a big impact on your options.

Conditional vs. unconditional home offers: the key differences

Unconditional offers

Conditional offers

You need to involve your lawyer in any conversations involving the sale and purchase agreement.

Can you really not back out of an unconditional home offer?

On the hunt for a house?

Check out the wide range of homes for sale on Trade Me Property.

Search now Author

Search

Other articles you might like